Recent Posts

Freelancing income

Investment plan

are you riding the silver wave too?

INDIA-EU FTA

How do i make money from AI

why i want an officer level govt jaab

NEETs assemble

India agreed to buy Gold and rare metals to fix th...

Modi ji talking about digital currency

I thought this would make me happy but

ultimate forex master

Do you agree??

नागरिक देवो भवः

Gst Reform discussion

Cian Agro Industries&Infrastructure Ltd

Thread to discuss the state of the economy

bros....

/FREE/bies thread

Matt levine newsletter

Beginner guider (Water thread)

test

BEST isp?

FD or Gold

BBC Money

Another instance where media is enemy of the peopl...

Beginner guider (Water thread)

Hus16p

No.316

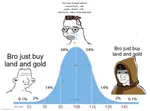

I will try to create a simple guide based on my investment journey so far.

1. Try to put at least 30% of your in hand income into equity/MFs, mostly MFs for beginners, anything more than 30 is a bonus but if you are depriving yourself of things then it is not good. Rest whatever savings you have you can put those into Debt instruments like PPF/GILT funds, more details I will add below. Avoid FDs as they require you to pay tds before payouts

2. If you have NPS option with your employer then you should max out your contribution as that contribution will be tax free. 14% of basic.

3. Early in your career don't worry too much about how much returns your SIP is generating, instead focus on how you can increase your contribution either via upskilling or additional savings(without denying yourself)

4. Don't expect magical returns from the market, MFs mostly serve to protect you from inflation, but the few percentage of inflation adjusted returns add up over a long period, hence the focus on SIP in MF advertisements.

5. Don't try to time the market, just SIP, if you keep waiting for a fall you would never be able to deploy properly, you would not get some insane returns even if you managed to time the market once or twice.

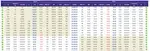

6. Beginner Equity funds- For the first few years you can go for the following index funds and one flexi cap - Nifty 100, Midcap 150, Parag parikh flexi cap.If you are investing in Equity MFs your timeframe should be at least 3 years. Diversification is good once you have done a few years of index funds, try to build up 10-20% of equity portfolio via US invested MFs, currently only one fund is available due to RBI restrictions but the Nasdaq and s&p funds should open up in some time. If you want to do directly, I do have some experience so you can ask me anything if needed.

7. Coming to debt investments, it is highly dependent on your tax bracket, if you fall in the 30% tax bracket you need to be smart about deploying debt savings otherwise taxes will end up eating your returns. Some ways to avoid this include arbitrage funds, dynamic/balanced advantage funds etc, let me know if you need more info.

8. Gold - You should keep around 5-10% in your portfolio, don't get carried away by hype. You can do via ETFs, MFs or digital gold or physical. Easiest is to do via MFs and ETFs but if you hold on to the the gold for 25-30 years you might end up paying more in management fees than the upfront and storage charges on physical gold.

9. Stay away from trading unless you have a lot of money left over after following the points above, you would most likely lose money like 95% of the traders.

10. Direct equity is kind of hit and miss, a lot of people think fundamental analysis is somehow superior to technical analysis but in reality it is pretty much the same for an average retail trader, you simple don't have info to make a good decision about the company you are buying into. The info which you have is abundantly available and can be analysed by a simple bot as well so make of that what you will. You can get lucky with direct equity but my suggestion would be to stay away unless you have lots of money left over after all the investments.

11. Buy health and life insurance when you are young, be honest on their application form, life insurance you don't need to take a massive cover as long you are confident you would be able to build a decent corpus by the age, just take it till 60.

All things considered, don't overfocus on saving money as mentioned in 1 and 3, there is no point saving money and watching your portfolio size go up, you are just cucking yourself out of happiness. I have pretty much done the same thing but I have realized my stupidity too late. Will add whatever comes to my mind later. Hope you learned something useful

6x3oxr

No.317

>>316(OP)

6x3oxr

No.319

>>316(OP)

Nisu thread desu. I need to work on the life insurance thing a bit. Also savings aspects - i have been very careless in fact...it's putting it mildly.

V16AJy

No.320

>>316(OP)

Goated thread, Vaishya Approved kek.

KzpLq6

No.321

>>316(OP)

Now that we are talking about it, I hab 28k right now, is there any way to make it 70k by end of January. Laptop khareedna hai mujhe

L0ssSF

No.322

>>321

Nifty looks confident. You could buy calls when participants finally agrees on taking it to new heights

Hus16p

No.323

>>321

Only way to do it is via gambling of some kind, if you are prepared to lose all your money I can give you some suggestions for options

KzpLq6

No.325

>>323

Batao, I will think about it

Hus16p

No.326

>>325

Will tell you after market open tomorrow

IAOE3U

No.327

>>325

Gambling is a big no.

caUUz/

No.329

>>325

Another lesson for you, don't take trading tips from random (by the way I am a nigger)s online

DNJEhY

No.330

>>316(OP)

Thanks sir you finally did it after asking you since last year kek