Recent Posts

Freelancing income

Investment plan

are you riding the silver wave too?

INDIA-EU FTA

How do i make money from AI

why i want an officer level govt jaab

NEETs assemble

India agreed to buy Gold and rare metals to fix th...

Modi ji talking about digital currency

I thought this would make me happy but

ultimate forex master

Do you agree??

नागरिक देवो भवः

Gst Reform discussion

Cian Agro Industries&Infrastructure Ltd

Thread to discuss the state of the economy

bros....

/FREE/bies thread

Matt levine newsletter

Beginner guider (Water thread)

test

BEST isp?

FD or Gold

BBC Money

Another instance where media is enemy of the peopl...

Another instance where media is enemy of the people

4buwRv

No.289

>India plugs loophole that allowed gold duty evasion

>Mint reported on 12 June that importers were using a loophole to bring in gold compounds—also called liquid gold—instead of actual gold to avoid paying the 6% duty.

>The Directorate General of Foreign Trade (DGFT) has amended its import policy, moving gold compound (HS code 28433000) from ‘free’ to ‘restricted’ list, according to a notification on 18 June. This means importers will now need a licence from the DGFT to bring such compounds into the country.

>Gold compounds, used in industrial applications, attract no duty if imported from the UAE, Japan and Australia, which have trade pacts with India.

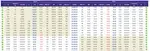

>Imports of such compounds soared 9.25 times over a year earlier and 2.84 times quarter-on-quarter to 69,879kg in the January–March period, according to data from the Directorate General of Commercial Intelligence and Statistics (DGCIS). That is equivalent to $1.29 billion worth of gold imports.

Now gawreeb peeps will have to find new ways to evade changuls of gormint.

4buwRv

No.290

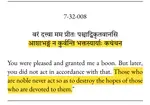

>>289(OP)

India plugs loophole that allowed gold duty evasion

Srushti Vaidya

[srushti.vaidya@livemint.com](mailto:srushti.vaidya@livemint.com)

Mumbai

India has placed gold compounds and 12 other items in the restricted trade category to curb evasion of import duty.

The Directorate General of Foreign Trade (DGFT) has amended its import policy, moving gold compound (HS code 28433000) from ‘free’ to ‘restricted’ list, according to a notification on 18 June. This means importers will now need a licence from the DGFT to bring such compounds into the country.

Mint reported on 12 June that importers were using a loophole to bring in gold compounds—also called liquid gold—instead of actual gold to avoid paying the 6% duty.

Gold compounds, used in industrial applications, attract no duty if imported from the UAE, Japan and Australia, which have trade pacts with India.

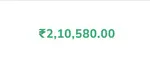

Imports of such compounds soared 9.25 times over a year earlier and 2.84 times quarter-on-quarter to 69,879kg in the January–March period, according to data from the Directorate General of Commercial Intelligence and Statistics (DGCIS). That is equivalent to \$1.29 billion worth of gold imports.

By comparison, actual gold shipments fell 51.2% sequentially and 0.9% over a year earlier to \$9.5 billion in Q4 FY25.

The government lost ₹906 crore in customs duty in FY25 because of import of gold compounds instead of actual gold, according to Mint’s calculations.

According to data from the DGFT, around 87% of the gold compound imports came from the UAE, Japan and Australia.

Till now, any individual could import liquid gold without any questions asked on its end-use.

In a separate notification, the DGFT put palladium, rhodium and iridium alloy with more than 1% gold under the restricted category.

According to the Customs Tariff Act, an alloy with platinum in excess of 2% qualifies as a ‘platinum alloy’.

7cImgo

No.291

>>289(OP)

yaar we need to staph thimking that we are usa of 21st century. we have to thimk like we are 15th or 16th century britain